|

Vol. 21, N°50. Cierre al 31 de diciembre de 2016 EISSN: 2215-3403 http://www.revistas.una.ac.cr/economia |

THE EFFECT OF PRIVATE PENSION FUNDS’ BIDDING ON FEES AND COMPETITION

EL EFECTO DE LA SUBASTA DE LOS FONDOS PRIVADOS DE PENSIÓN EN LAS COMISIONES Y COMPETENCIA

Jorge Guillén Uyen1

Abstract

This paper sheds light on the effect of bidding recent private pension funds on fees and competition. In order to accomplish the latter result, we used panel data of ten Latin American countries organized in quarters from 2005-2015. The reform of the private pension system in some countries in the region allows for the implementation of a mechanism of auctions on fees to capture new members. The objective of this mechanism was to drop fees and promote competition. We concluded that the effect on fees is successful since fees dropped while the effect on competition is ambiguous according to our panel data model and the measurement of efficiency. Results are relevant to regulate policies in the market of precautionary savings.

Keywords: DEA; private pension funds; bidding; transfers.

Resumen

Este trabajo aclara el efecto de las recientes subastas de fondos privados de pensión en las comisiones y la competencia. Para lograr este último resultado, utilizamos datos de panel organizados por trimestres, de diez países latinoamericanos, de los años 2005-2015. La Reforma del sistema privado de pensiones en algunos países de la región permite la implementación de mecanismos de subastas sobre el precio para captar nuevos afiliados. El objetivo de este mecanismo fue bajar las tarifas e incentivar la competencia. Hemos concluido que el efecto sobre las tarifas es exitoso al bajarlas, mas el efecto sobre la competencia es ambiguo según nuestro modelo de datos de panel y la medición de eficiencia. Los resultados son relevantes para la regulación de las políticas en el mercado de ahorro previsional.

Palabras claves: DEA; fondos privados de pensión; ofertas; transferencias.

Fecha de recepción: 10-08-16. Fecha de reenvío: 28-10-16 / 03-11-16 / 07-11-16.

Fecha de aceptación: 08-11-16. Fecha de publicación: 21-11-16

Doi: http://dx.doi.org/10.15359/eys.21-50.3

1. Introduction

The private pension fund (Fully Funded) is a system previously formed in Chile and it has been reproduced in several countries of Latin America and Western Europe (Müller, 2003; Mesa-Lago, 2008). In addition, Chile is the only country that has a private pension system (Fully Funded) without competing with public pensions (Pay pay as You Go System)2. The main motivation of this paper is to find out whether regulation in the precautionary saving is working.

Pay as You Go System is a public organism which is called “The Otto Von Bismarck System.” It is based in a collective fund where young people provides retirement pension to the elderly. This system is unsustainable over the time3. In the Pay as You Go System, the number of retired people increases significantly over time in a scenario where the aging population rises at a rapid growth rate. Whenever the latter situation happens, the population pyramid gets broader on the peak and narrower on the base (see World Bank, 1994) making the system unsustainable due to the lack of resources that comes from the young to the elderly.

In the Latin America region, the Pays as You Go System and the Fully Funded coexist. However, there is a high number of not covered people for precautionary savings (see Kay, Stephen J. and Sinha, Tapen, 2007; Lusardi and Mitchell, 2007; Bernstein et al., 2006 and Rofman and Lucchetti, 2006).

In addition, there are still some concerns about the Private Pension Fund System (see for Mesa-Lago, 2014). There are some advantages and flaws in the particular system: issues like the lack of coverage, data problems to clearly differentiate affiliate and contributor, social dialogue to communicate the information, social solidarity problems which are not yet solved, lack of competition and diversification of portfolio4.

In this sense, some mechanisms of re-reforms of private pension funds have been implemented in the Latin America region as well as some Eastern European countries (Mesa-Lago, 2008). It is not quite sure how the re-reform may be completely accomplished given the different problems stated above5.

The paper attempts to shed the light on some persistent problems in the Fully Funded System. The problem about lack of competition reflected in high prices charge to the affiliated is faced here. The price in the private pension fund can take the shape of a fee on balance, wage (flow) or a fixed fee. We will do the assessment on the determinants of the fee charge by private pension funds. In most of the countries of the Latin American region the fee is charged on the wage (fee on flow)6.

In addition and using previous estimation, we will explore the determinants of the competition in the system measured by transfers in the private pension funds (same proxy is used by Bernstein et. al., 2007). We will conclude that there is not major effect in price or any significant effect in competition after the bidding of private pension funds’ fees.

The paper is organized as follows: Section 2 describes the data and primary estimation methods to conduct the research. Section 3 shows the model to test our hypothesis about the main drivers of fees and the competition; the latter variable is measured by transfers in the private pension. Section 4 presents preliminary results, section 5 the model results and the last section (Section 6) concludes.

2. Data

We have used the financial statements of all private pension funds within the following countries: Argentina, Bolivia, Colombia, Chile, Costa Rica, Dominican Republic, Mexico, Peru, El Salvador and Uruguay. We have excluded Panama since there is a lack of information to complete the data envelopment analysis and the panel data that will be explained in the next section of the paper.

Our period of analysis starts in March 2005 and finishes in June 2015; this is the whole available information in Asociación Internacional de Organismos de Supervisión de Fondos de Pensiones (2015), (AIOS, for its Spanish acronym). The information is quarterly, so there are 42 periods of time and 73 private pension funds for the 10 countries under evaluation. There are 3 066 observations in the panel that allow us to contrast our main hypothesis about determinants of fee and transfer in the pension system 7.

The data in AIOS permitted us to estimate indicators of efficiency that will be a primary input to find out the determinants of fee and transfers. Next subsection will describe the methodology of estimates of efficiency for every single private pension fund within the sample.

2.2 Data Envelopment Analysis technique

In this section we present the technique to determine private pension funds’ efficiency. In the past, average productivity of labor was used to measure efficiency, but this indicator failed to use all the information of inputs and outputs available at the same time (Farrel, 1957). Cooper et al. (2004) provided the following definition of “relative efficiency” that solves the problem of the efficiency indicator used in the past:

A Decision Making Unit (DMU) is to be rated fully efficient on the basis of available evidence if and only if the performances of other DMUs do not show that some of its inputs or outputs can be improved without worsening some of its other inputs or outputs. (p. 430)

In order to account or better estimate the private pension funds’ relative efficiency, we use DEA (Data Envelopment Analysis) technique. The DEA comes from the original work of Charnes, Cooper and Rhodes (1978) as well as Farrel (1957). These authors introduced the basic idea of measuring relative efficiency using Euclidean distances from a given observation to an optimal “relative frontier”. The word “relative” is used because it is constructed based on sample information. A DMU (private pension funds in our case) located on the frontier receives a score of one, while private pension funds located below the frontier receive scores lower than one. Later, Charnes, Cooper and Rhodes (1978) introduced a linear program to estimate measures of efficiency by introducing several inputs and outputs at the same time.

As private pension funds outputs, we use total revenue and number of contributors. Private pension fund(’)s inputs will be administrative cost and sale cost. This input/output selection has been considered according to previous empirical analysis by Barrientos (2001) and Pestana et al.(2008). The availability of data for all the private pension funds previously described in Section 2, allows us to construct the indicator of efficiency according to the DEA methodology.

The selection of these multiple inputs and outputs permit the private pension fund to have the right management decision, necessary to incorporate the best input allocation and product mix needed to attract contributors and make favorable investments. Same idea can be taken from Berger and Mester (1999), Barr, Killgo and Siemens (1999) for banking approach8. Next section will describe the model specification9.

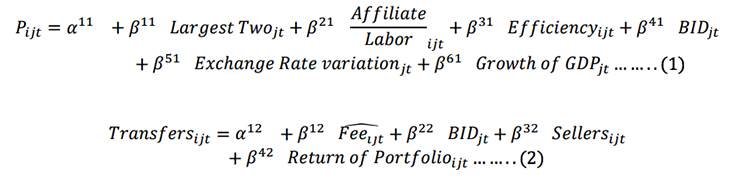

3. Model specification

This section will introduce the model to test the determinants of fee and the effect on competition in the private pension system. The proxy for competition is “transfers of affiliates”10 which is also used by Bernstein et al. (2006) for similar market assessment. Since there is a lack of information in the fee on balance and fixed fees, the price “Pijt” is considered as fee on flow11. We have constructed the equivalent fee on flow for the countries with different fee system12.

In order to capture the relevant variables that explain the fee or price charge by private pension funds, we have the following model:

i: Private pension fund

j: Country where private pension fund is located

t: Period of time considered

In the first equation, the variable “Largest two” considers the market share of the first two private pension fund. The variable may explain prices in the precautionary saving market. We may expect the sign of this variable to be positive and is a proxy of concentration as well. If the market concentration increases, then prices may increase due to the lack of competition. For the banking sector, Berger (1995) found that this is a relevant variable and may exert an influence in interest rate due to market power13.

The variable “Affiliate/Labor” is a proxy of coverage which is used by Rofman and Lucchetti (2006) and World Bank (1994). We expect the sign of this variable to be negative. As long as coverage increases, it provides economies of scale to the sector and gives the institutions some room to drop prices14.

The variable “Bid” is a dummy that assumes the value of “1” or “0”; it has the value of “1” if there is a bid of new affiliates within a period of time and “0” otherwise. Countries like Peru, Mexico, Chile and Colombia had bid over the sample size and we have to test whether the bid dropped prices and generated competition in the market. According to the literature in private pension funds, this is a mechanism that is supposed to drop prices and generates competition in the system (Kay and Sinha, 2007). Then we expect the sign of this variable to be negative with respect to the price.

Finally, the macroeconomic variables: exchange rate and GDP growth are control variables that may expect to influence negatively on the price levels of private pension funds. These variables are widely used in the financial literature to control time and positive external effect (Aggarwal et al., 1999, and Hamilton and Lin, 2001).

For the second equation, the transfer is modelled as a function of fee, bid, sellers and return of portfolio. The purpose here is to find out what the impact of bid is on transfer of affiliates. We expect the fee to be negatively related to the transfers. As long as price increases, there is not any incentive to move to the respective private pension fund with higher prices. This is like a demand that is negatively related to the price.

We have also included bid that works inversely with respect to the price effect, then its sign should be positive. If there is a bid, then the price should move down and so increase transfers in the private pension funds15.

According to Bernstein et al. (2006) we have also included the variables sellers and return of portfolio to determine the behavior of transfers. We expect the sign of sellers to be positively related to the transfers. As long as sellers increases, it is likely that transfers increase. The return of portfolio works in the same way: if it increases then some private pension funds become attractive and the transfers increase.

4. Preliminary Results

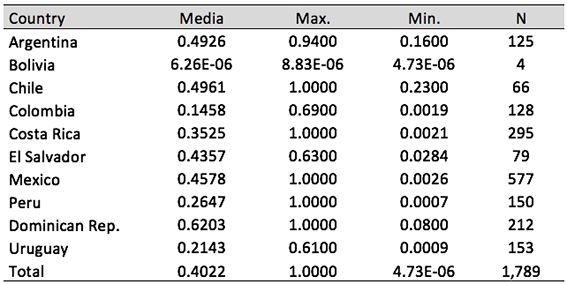

Table 1 shows some statistics regarding estimations of efficiency for private pension funds (PPF). The measurement of efficiency is in absolute terms. We mean absolute because it is the ranking of Decision Making Units (DMU) across countries. Therefore it is possible to compare the assignment of resources regardless the country location of the pension institution.

Table 1.

Statistics for private pension fund’s efficiency

Source: Own elaboration

The table shows means of efficiency by country for the whole period under assessment, which varies from march 2005 to December 2015. Dominican Republic and Mexico are the countries with the highest score of efficiency. In contrast, Bolivia got the lowest score with high volatility for their two private pension funds in the sample. The lack of information as regards this country could not permit us really to estimate scores of efficiency.

It is surprising to see that Argentina got an average score of efficiency close to 0.49 for the periods under consideration. Some of the private pension funds hit a score of 1 which is the highest indicator of efficiency in the non-parametric estimation method explained in previous section. Despite Argentina had financial sustainability problems that opened the chance of government expropriation, it was able to record an efficiency score close to the average of their existing peers in the Latin America region.

Private pension funds in Chile achieved an average efficiency score of 0.496 for the sample. Despite Chilean private pension funds are the oldest in the region, the Fully Funded System in Chile started in 1981, at least 15 years before its peers in the region. Aside from Bolivia, there is not much dispersion in the indicator of trend for the countries under evaluation.

This indicator of efficiency is a perfect proxy of management according to the financial literature. The papers of Charnes, Cooper and Rhodes (1978), Berger and De Young, Hassan and Kirchhoff (1997), Cheng et al. (2001) and Berger and Mester (1999) are a good example of applications of the Data Envelopment Technique to the financial sector. The indicator of efficiency which is an approximation of management will be considered in the assessment of the determinants of price and transfer of private pension funds.

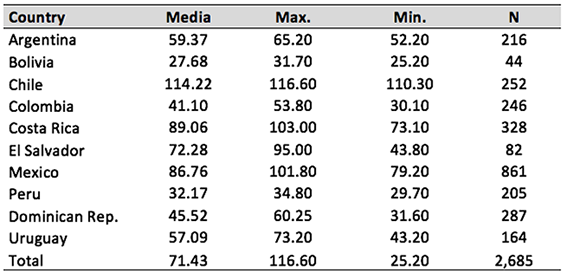

Table 2 shows some descriptive statistics for the coverage of each country across the sample under study. In contrast to the low dispersion of results shown in the previous table, the dispersion of data is high here. The scores may vary from 145 to 41, which is a high volatility across the analyzed countries.

Table 2.

Statistics for the ratio of affiliates to labor force (coverage)

Source: Own elaboration.

The higher the score the greater the coverage is achieved. A score of one hundred is the ideal to attain because it means that the full labor force is affiliated. Scores below 50% reflect a lack of coverage and it goes hand in hand with informality17 (see Rofman and Lucchetti, (2006)). The highest the informality, the lowest the coverage indicator

.The low coverage and informality is a latent problem in the Latin American region due to the market frictions in the financial and labor sector (see for the example the work of Loayza, 2008)18. Bolivia and Peru have the lowest score of coverage in the region hitting only one third of the labor force. It means that many people in this country will go either to social programs or will not have any retirement pension at all19. Market frictions and informality in the labor and financial sector can be a key element that may explain the results obtained for these countries. Bolivia and Peru have almost the same coverage associated with high levels of informality.

In addition, we have to notice that there is not any change of trend across the time in this set of counties. The maximum and minimum score of coverage is almost the same within Bolivia and Peru. So, there should be a persistent problem of informality and coverage over the period of time.

Chile has an indicator above 100, which can be explained due to minors registered in the financial institutions. In addition, this is the only country in the sample that does not have a Pay as You Go System or Otto Von Bismarck System (see Piñeira, 1991 and 1995 for a detailed explanation). Therefore, there is no possibility that the labor force may decide for other system rather than the Fully Funded or Private Pension Funds.

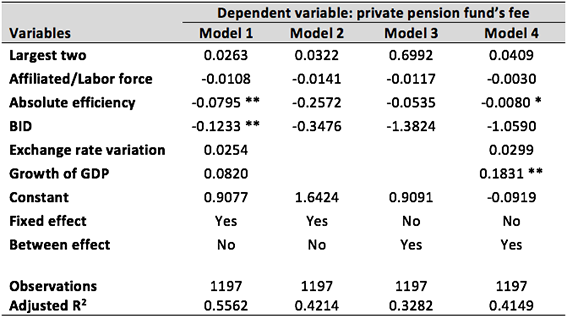

5. Model results

The following Tables 3 and 4 show the panel data estimations for the sample. The estimation are based on the model 3 described above. These tables include fixed and between effect estimations in order to control countries and periods of time. The estimation considers the data for 10 countries and 44 periods of time (quarters)20.

Table 3.

Determinants of private pension fund’s fee

***Significant at 1%

**Significant at 5%

*Significant at 10%

Source: Own elaboration.

Table 3 considers the formulation 1 described in the previous section of the paper. The purpose is to find out the determinants of the private pension fund’s fee. Several specifications of the variables are considered under fixed and between effects. We found that more efficiency drops fees which are consistent with Forster and Shaffer (2005).

The latter result holds even when we control by either fixed or between effects. It means that when we capture the effect of individuals or period of time, there is always a negative and significant relationship between efficiency and fees.

Also the variable bid is negatively correlated to fees. So it means that more competition allows dropping the price charge by private pension funds21. The latter results happen when we control by fixed effects, or when the sample is controlled by any variations of individuals. Also, the bid effect can be captured across the time. The drop in prices comes along the time due to the increase in competition22.

Only one macroeconomic variable resulted significant: growth of GDP in the between effect estimation, when we control among countries and there is a change over the time. The macroeconomic variable exchange rate did not result significant in both estimations fixed and between effect estimations.

The sign of the coefficient for every single variable is always preserved for the four different models in Table 3, even in the case of significant or insignificant results. The adjusted R2 was low but our purpose was not to predict the fee but to find out the determinants of this price. We have a large number of observations for inference: 1 197 after adjustment in the sample.

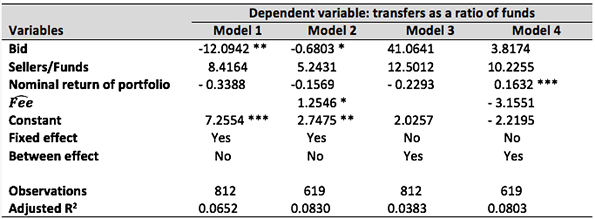

Table 4.

Determinants of transfers as a ratio of funds

*** Significant at 1%

** Significant at 5%

* Significant at 10%

Source: Own elaboration

Table 4, presents the panel estimation for the transfers in the private pension funds. The dependent variables are transfers in the private pension funds. As it is mentioned in the previous section of the paper there is a correlation between fee and bid, so we have used the residuals of previous estimation to incorporate to the regression in Table 4. The residuals of previous estimations capture the fee without any influence of bid, coverage and expenditure of private pension funds.

The residuals permit us to avoid any endogeneity problems between fee and the remaining variables like bid. This is a two-step estimation that allows us to get consistent and reliable estimators23. As the previous estimation, there is also a control among countries and time effect.

The variable bid is negatively correlated to the transfers. It means that more bidding leads to less transfer in the private pension funds24. This is a result contrary to the expected sign that happens across individuals in the fixed effect estimations. When we control by time in the between effect estimation, there is no relationship with respect to transfers or competition in the sector. In the between effect estimation, bidding may affect negatively the price but does not influence the incentive to move to the winner of the bid25.

The variable sellers as ratio of the funds resulted non-significant but the sign is as we expected. The increase in the number of sellers may increase transfers because the handle of resources assigned for marketing purpose should capture new customers.

The variable return of portfolio resulted non-significant, but for model 4 it was positively correlated to transfers. The more the return the better the incentive to move between private pension funds looking for a suitable portfolio for precautionary savings. The variable Fee which is the predictor of fee, is removed from the influence of bid, resulted significant in the fixed effect estimation (Model 2). The higher the price charged to manage funds, the greater incentive to move from one private pension fund to another which is contrary to the expected. Then competition is not influenced by our adjusted price and bid.

Adjusted R2 is very low, but our purpose is to find the determinants of bidding instead of forecasting the number of transfers in the private pension funds. We also missed some observation because it is a two-step regression that considers residuals of previous estimation.

6. Conclusions

In this article, we have tested the determinants of fee or price charge by private pension funds and the determinants of transfer in this financial system. We have found that there is a significant and negative effect of bid on the private pension fund’s fee. However, there is not any incentive to transfer to the private pension funds.

Despite the drop in fees because of bidding, there is not any incentive to move because the demand for private pension funds not only depends on price but more on other relevant variables like return of portfolio, services and institution’s prestige. Our study goes along the line with Bernstein et al. (2006) who tested a similar study for a Chilean database. We have used a sample of ten Latin American countries where the bidding effect pushes down prices but has not any effect on transfer and competition in the Private Pension Fund System.

We have also find interesting results that can be done for future research. The fact that informality influence negatively coverage of private pension funds is important to evaluate. Countries like Peru and Bolivia have this problem that may be a barrier to drop fees and improve consumer’s welfare. Efficiency of Private Pension funds is also an important topic to do the future assessment as well, given the different regulations that have been implemented in the region.

Our finding can be used by the regulator in order to proceed with the right assessment of any regulation in the private pension funds. Besides the problem of the effect of bid, we also found that there are some caveats in the system, which need to be fixed. The problem of coverage and competition is still a lack in the precautionary savings system.

Notes

1 Professor of Finance. ESAN Graduate School of Business. Lima, Perú. PhD. E-mail: jguillen@esan.edu.pe

2 The Fully Funded System is also called Private Pension Fund System and the Pay as You Go System corresponds to the public sector.

3 For more about this phenomenon, see Bernal, N. et al. (2008), and also Kay, Stephen J. and Sinha, Tapen, (2007). They describe how Peru and Latin American region will face an inverted population pyramid through 2025; similar phenomenon experienced developed countries some years ago. It makes the system unsustainable.

4 Also see Calvo et al. (2010).

5 Piñeira (1991) claims that Fully Funded is more sustainable in comparison to Pay as You Go. However he does not point out the limitations and flow in the Fully Funded System.

6Piñeira (1991)In some countries with a different fee system, we have constructed the equivalent fee on flow to make them comparable to each other.

7The system collapsed because in 2000 the portfolio of “Argentinian AFJPs” concentrated in sovereign bonds went to default. The Argentinian affiliates lost the contributions and the social pressure triggered the expropriation (see Carmo, 2012).

8There are more approaches besides the described above.

9Also Charnes, A.; Cooper, W.; Sun, D. B. and Huang, Z. M. (1990) and De Young (1998).

10Some authors use profit margin and mark up as proxy (Neiss, 2001). We use the ratio transfer divided by funds.

11The charge is a percentage on the salary of the affiliate.

12There is a discussion how to construct it, see for more detail Chavez Bedoya (2016). We have not considered aversion or density just the equivalent between fee on flow and balance. In Peru the bidding is on balance but the fact that we have change the commission to flow made us capture the all the regulation effects.

13Berger stated four hypotheses about banking sector. Two of them are: Relative Market Power and Structure Conduct Performance hypotheses. The Relative Market Power hypothesis claims that firms with large market shares and well-differentiated products are able to exercise market power (Monopolistic competition). The Structure Conduct Performance asserts that concentration permit less favorable condition to consumers: low rates of deposits and higher loan rates.

14See the seminal paper of Rinstad (1974) and Hall (1989)

15In order to avoid any correlation between price and transfers. In the second equation we have included a predictor of the price that comes from the residuals of the first regression. This predictor reflects the price but removed from the influence of coverage, expenditure of private pension funds and bid.

16The proxy of coverage is the ratio of affiliates to private pension funds divided by the labor force. This is a proxy widely used in the financial literature. See AIOS reports and Rofman and Lucchetti (2006).

17 There is also a good review of this indicator or informality in the compilation of Kay and Sinha (2007).

18Also see similar conclusions of market frictions and inequality in Das and Mohapatra (2003) and Arestis and Caner (2004).

19It is possible that some of these people not accounted in the ratio may go to the Pay as You Go System which is based in a collective fund.

20Random effect is not considered since we have done the Haussman test and rejected any possibility of randomness in the estimation.

21It goes along the line with Forster and Shaffer (2005) and Kay and Sinha (2007).

22We have also tested that Structure Conduct and Market Power do not necessarily hold in the Private Pension Fund System. These are explained in previous sections.

23Also Haussman test is run to test for random effect. Like in the previous estimation, we have discarded any possibility if randomness in the estimation.

24This is a proxy variable of competition that is affected positively with biding. The financial literature claims that there should be a positive relationship between bid and transfers (competition).

25We should mention a limitation here. We can control of bidding but not for individual movements. The estimation of transfer is at the aggregate level due to the lack of available information.

References

Aggarwal, R., Inclan, C. and Leal, R. (1999). Volatility in emerging stock markets. Journal of Financial and Quantitative Analysis, 34(1), 33-55. Retrieved from https://www.jstor.org/stable/2676245?seq=1#page_scan_tab_contents

Arestis, P., & Caner, A. (2004). Financial liberalization and poverty: Channels of influence. (Working Paper Nº 411). Retrieved from the web site Levy Insitute: http://www.levyinstitute.org/pubs/wp411.pdf

Asociación Internacional de Organismos de Supervisión de Fondos de Pensiones (2015). Various publications. available at http://www.aiosfp.org/

Barr, R., Killgo, K. and Siems, T., & Zimmel, S. (1999). Evaluating the productive efficiency and performance of U.S. commercial banks. (Working Paper). Retrieved from Federal Reserve Bank of Dallas: https://core.ac.uk/download/pdf/6592998.pdf

Barrientos, A., & Boussofiane, A. (2001). The efficiency of pension fund managers in Latin America. (Working Paper 11/2001). Retrieved from the web site University of Manchester: http://ageconsearch.umn.edu/handle/30696

Berger, A. (1995). The Profit-Structure Relationship in Banking--Tests of Market-Power and Efficient-Structure Hypotheses. Journal of Money, Credit and Banking, 27(2), 404-431. Retrieved from http://www.jstor.org/stable/2077876?seq=1#page_scan_tab_contents

Berger, A., & De Young, R. (1997). Problem loans and cost efficiency in commercial banks. Journal of Banking and Finance, 21(6), 849-870. Retrieved from https://www.federalreserve.gov/pubs/feds/1997/199708/199708pap.pdf

Berger, A. and Mester, L. J. (1999). Explaining the dramatic changes in performance of US banks: Technological change, deregulation and dynamic changes in competition (Working paper NO.01-6). Retrieved from http://fic.wharton.upenn.edu/fic/papers/01/0122.pdf

Bernal, N., Muñoz. A., Perea H., Tejada, J., & Tuesta D. (2008). Una mirada al sistema peruano de pensiones: diagnóstico y propuestas. Estudios previsionales del BBVA. Retrieved from https://www.bbvaresearch.com/KETD/fbin/mult/Unamiradaalsistemaperuanodepensiones_tcm346-189603.pdf

Bernstein, S., Larraín G., & Pino, F. (2006). Chilean pension reform: Coverage facts and policy alternatives. Economia 6(2), 227-279. Retrieved from https://www.jstor.org/stable/20065500?seq=1#page_scan_tab_contents

Bernstein, S., y Carolina, C. (2007). Los determinantes de la elección de AFP en Chile: nueva evidencia a partir de datos individuales. Estudios de Economía (34)1, 53-72. Recuperado de http://www.econ.uchile.cl/uploads/publicacion/e6e6700d-962d-4640-a612-2c10a9bfda9e.pdf

Calvo, E., Bertranou, F., & Betranou, E. (2010). Are old-age pension system reforms moving away from individual retirement accounts in Latin America? Journal of Social Policy, (39)2, 223-234. Retrieved from https://www.cambridge.org/core/journals/journal-of-social-policy/article/are-old-age-pension-system-reforms-moving-away-from-individual-retirement-accounts-in-latin-america/B698BF79AFF639A75AE81CBE68D7284C

Carmo, M. (2012). Argentina: On the slippery slope to full nationalization. The Brazilian Economy, 4(2), 33-37. Retrieved from http://bibliotecadigital.fgv.br/ojs/index.php/be/article/view/21913

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operations Research, 2(6), 429-44. Retrieved from http://www.sciencedirect.com/science/article/pii/0377221778901388

Charnes, A., Cooper, W. W., Sun, D. B. & Huang, Z. M. (1990). Polyhedral cone-ratio DEA models with an illustrative application to large commercial banks. Journal of Econometrics. (46), 2, 73-91. Retrieved from http://www.sciencedirect.com/science/article/pii/030440769090048X

Chavez Bedoya (2016). The effects of risk aversion and density of contribution on comparisons of administrative charges in individual account pension systems. Journal of Pension Economics & Finance, 15(2), 1–20. Retrieved from https://www.cambridge.org/core/journals/journal-of-pension-economics-and-finance/article/the-effects-of-risk-aversion-and-density-of-contribution-on-comparisons-of-administrative-charges-in-individual-account-pension-systems/F0A2A92A61C46EE499685B8B777F1279

Cooper, W. W., Seiford, L. M., & Zhu, J. (2004). Data envelopment analysis: History, models and interpretations, in Cooper, W. W., Seiford, L. M. and Zhu, J. (Eds.), Handbook on Data Envelopment Analysis (pp. 1-39). Retrieved from http://link.springer.com/chapter/10.1007%2F1-4020-7798-X_1#page-1

Das, M., & Mohapatra, S. (2003). Income inequality: The aftermath of stock market liberalization in emerging markets. Journal of Empirical Finance, (10)1-2, 217-248. Retrieved from http://www.sciencedirect.com/science/article/pii/S0927539802000257

De Young, R., Hassan I., Kirchhoff B. (1998). The impact of out-of-state entry on the cost efficiency of local commercial banks”. Journal of Economics and Business, 50(1), 191-203. Retrieved from http://www.sciencedirect.com/science/article/pii/S0148619597000775

Farrel, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society, 120(3), 253-290. Retrieved from https://www.jstor.org/stable/2343100

Forster and Shaffer (2005). Bank efficiency ratios in Latin America. Applied Economics Letters, (12), 529–532. Retrieved from http://www.tandfonline.com/pricing/journal/RAEL20

Hall, R. E. (1989). Invariance properties of Solow's productivity residual (Working Paper No. 3034). In P. Diamond (ed.), Growth, Productivity, Unemployment. Retrieved from http://www.nber.org/papers/w3034.pdf

Hamilton, J. and Lin, G. (2001). Stock market volatility and the business cycle. Journal of Applied Econometrics, 11(5), 573-693. Retrieved from http://www.jstor.org/stable/pdf/2285217.pdf

Kay, S., & Sinha, T. (2007). Lessons from Pension Reforms in the Americas. Retrieved from http://www.pensionresearchcouncil.org/publications/pdf/0-19-923077-6.pdf

Loayza, N. (2008). Causas y consecuencias de la informalidad en el Perú. Revista de Estudios Económicos, 15, 43-64. Retrieved from http://www.bcrp.gob.pe/docs/Publicaciones/Revista-Estudios-Economicos/15/Estudios-Economicos-15-3.pdf

Lusardi, A., and Mitchell, O. (2007). Babyboomer retirement security: The roles of planning, financial literacy, and housing wealth, 54(1) 205-224. Retrieved from http://www.sciencedirect.com/science/article/pii/S0304393206002467

Mesa-Lago, C. (2008). Reassembling social security: A survey of pension and health care reforms in Latin America. Retrieved from https://global.oup.com/academic/product/reassembling-social-security-9780199233779?cc=pe&lang=en&

Mesa-Lago, C. (2014). Reversing pension privatization: The experience of Argentina, Bolivia, Chile and Hungary (Working Paper Nº 44). Retrieved from web site extension of social security: http://www.social-protection.org/gimi/gess/RessourcePDF.action?ressource.ressourceId=43277

Müller, K. (2003). Privatizing old-age security: Latin American and Eastern Europe compared. Retrieved from https://searchworks.stanford.edu/view/5507359

Neiss, K. (2001). The markup and inflation: Evidence in OECD countries. The Canadian Journal of Economics, 34(2), 570-587. Retrieved from https://www.jstor.org/stable/3131869?seq=1#page_scan_tab_contents

Pestana, C., Ferro, G. and Romero, C. (2008). Technical efficiency and heterogeneity of Argentina pension funds (Working Paper Nº 29). Retrieved from the web site https://aquila1.iseg.utl.pt/aquila/getFile.do?method=getFile&fileId=26530

Piñeira, J. (1991). El cascabel al gato: la batalla por la reforma previsional. Retrieved from http://www.josepinera.org/zrespaldo/el_cascabel_al_gato.pdf

Piñeira, J. (1995). Empowering workers: The privatization of social security in Chile. CATO, 15(2), 1-18. Retrieved from https://object.cato.org/sites/cato.org/files/pubs/pdf/cl-10.pdf

Rinstad, V. (1974). Some empirical evidence on the decreasing scale elasticity. Econometrica, (42), 1, 87-102. Retrieved from https://www.econometricsociety.org/publications/econometrica/1974/01/01/some-empirical-evidence-decreasing-scale-elasticity

Rofman, R., y Lucchetti, L. (2006). Sistema de pensiones en América Latina (Discussion Paper 0616). Retrieved from de web site World Bank: http://siteresources.worldbank.org/SOCIALPROTECTION/Resources/SP-Discussion-papers/Pensions-DP/0616Spanish.pdf

World Bank (1994). Averting the old-age crisis. Retrieved from http://documents.worldbank.org/curated/en/973571468174557899/pdf/multi-page.pdf